Swedish equipment vendor Ericsson said Monday that its reorganization project is running according to plan and the new organization will be up and running as of January 1. However, the company said it "has identified certain excess headcount as a consequence of the new organization." Although Ericsson has said it will reduce headcount by an offer of voluntary resignation to the affected employees, local press reports suggest that the firm is looking to shed 400 jobs. Those who take voluntary resignation will be able to apply for severance payment or permanent employment with Manpower as a consultant, Ericsson said. The company has formed an agreement with Manpower to facilitate redundancies.

Ericsson's restructuring is designed to target new developments in mobile and fixed broadband and the shift towards next generation networks. Ericsson is implementing a more customer-oriented organization with three business units - Networks, Global Services and Multimedia. Carl-Henric Svanberg will remain as chief executive officer and president, Karl-Henrik Sundstrom will be executive vice president and chief financial officer, while Kurt Jofs will be executive vice president and general manager of Networks, Hans Vestberg will be executive vice president and general manager of Global Services and Jan Wareby will be senior vice president and head of Multimedia.

A slightly slanted view at the telco / mobile/ content world. Whats happening, the news and of course comment and market analysis.

Monday, November 27, 2006

Friday, November 24, 2006

PicoCells and O2

Further to his article, here is a detailed analysis of the positioning of pico cells in the UK market.

Earlier this year, the frequencies 1781.7-1785MHz paired with 1876.7-1880MHz were made available under the Wireless Telegraphy Act (WTA). Two sets of 3.3MHz is a valuable commodity in terms of spectrum, so Ofcom "raffled" them off to the highest bidders with a reserve price of £50,000 per license. Up to 12 licenses would be awarded. Ofcom allowed anyone to bid on any number of license slots (i.e. from one to 12 licenses) and the award was made purely on a financial basis. Ofcom arranged the auction in a sealed bid process in a "what you bid is what you pay" arrangement, which led to the lowest price paid at £50,110 by Spring Mobil and the highest £1,513,218 by COLT.

Some have argued that the highest bidders paid over the odds, but Ofcom is putting a good spin on it saying it's in line with its mobile strategy. The total amount of the licence fees paid was £3.8m - not bad for Ofcom's first spectrum auction. Of course, compared to the license fees paid for 3G spectrum (around £6bn per license) it's peanuts.

In the end it was close, but 12 licenses were awarded. They are national UK licenses, though the operators of the licenses have to cooperate so they don't interfere with each other. As part of the license condition all licence holders had a obligation to Ofcom to agree on an engineering co-ordination plan for the joint use of spectrum. The industry group is called Mobile200 and 11 licensees joined - O2 was awarded observer status for the discussions as it refused on principle to pay to negotiate the code of practice. Though the licenses are only low power (sub 200mW compared to tens of Watts for traditional GSM systems), they are suitable for services such as in-building GSM, local area GSM (such as in a theme-park) or other constrained areas. There are 15 GSM channels available, each one being able to carry eight voice calls.

Having a reasonable number of channels will allow multiple operators to co-exist in an area and also allow single operators to cover larger areas (in such a way that multiple GSM basestations won't interfere with each other). If the cell is mounted on an external mast, it can't be more than 10 metres high, however, in-building use can be to any height (so build a plastic greenhouse on a terrace on Canary Wharf and you can get an "internal" cell quite high).

The 12 companies winning licenses and the prices they paid were:

British Telecommunications PLC - £275,112

Cable & Wireless UK (England) - £51,002

COLT Mobile Telecommunications Ltd - £1,513,218

Cyberpress Ltd - £151,999

FMS Solutions Ltd - £113,000

Mapesbury Communications Ltd - £76,660

O2 (UK) Ltd - £209,888

Opal Telecom Ltd - £155,555

PLDT (UK) Ltd - £88,889

Shyam Telecom UK Ltd - £101,011

Spring Mobil AB - £50,110

Teleware PLC - £1,001,880

Having a license is all very well, but now licencees must be wondering what they've got themselves into. Just because they can run a GSM service doesn't mean anyone will use it, in fact it may well be difficult to get people onto your network. It's extremely unlikely the existing mobile operators are going to want to have anything to do with these new upstarts, they've invested millions (err, billions) to get to where they are today. The last thing they want is new entrants poaching customers or moving users off their networks when they move into, say, an office environment. They especially don't want their customer doing it with equipment (i.e. handsets) that they've heavily subsidised.

Unfortunately, what this means is that the new players are going to have to issue new SIMs (subscriber identity modules) and they won't work on existing GSM networks, or users will manually have to select the new network when they're in range. This makes it all very difficult, and users won't bother if it's hard. New entrants could enter into roaming agreements with the current operators, but unless Ofcom mandates this (which is unlikely) there's likely to be strong opposition. Since some of the license winners already have GSM networks, they can offer localised services knowing there's no interference problems with existing infrastructure.

One way ahead is for a licensee to make an agreement with a foreign operator and the localised network just becomes an extension of their network, but then when users roam on to the network they'll be subect to roaming charges which, as both Ofcom and the EU Government know too well, can mean very high charges for the end-user. If roaming charges do decline, this may well be a way forward.

There's also a big potential opportunity for the Channel Islands GSM networks here, as they abide by UK numbering plans, so though they are considered "foreign" their numbers look like UK numbers, including mobile ranges. They could offer roaming agreements and even offer SIMs which would still look like UK numbers, unfortunately as they are foreign operators, high roaming charges still apply. Just because the licensees have got a license, that doesn't give them the facilities to run a GSM network, it just allows them too. There's much more that's actually required to put a GSM network in place, all MMSC/SMSC, HLR etc.

If a big mobile operator was to offer a pico cell solution, they generally have a major problem as they don't want the pico cell to interfere with their existing network. Operators use what's known as a seven cell repeat patern. Each cell has six sectors (the six aerials that can be seen on a cell site). Cells and sectors can't use adjacent frequencies or they'll interfere. The seven cell repeat pattern ensures that frequencies can be re-used without interfering, but in the next seven cell pattern. O2 now has a very efficient way of dropping new cells into places, using new frequencies which are guaranteed not to interfere with O2's existing network - or any other major operator's. It does have to mind other GSM "pico operators", but as the power output is small, even this can be easily mitigated. It has a choice of 15 frequencies, so even if another "pico-operator" is nearby, they can both choose different (non-adjacent) ones.

Where O2 really gains is in the in-building/home use. One of the major costs of providing a GSM network is getting the calls back from the cell. By utilising a pico cell and a broadband connection, O2 has reduced this to practically zero, so it can offer cheaper calls just on that reduction. O2 does need to convert the calls to VoIP (voice over IP) and that increases the bandwidth required (GSM encoding uses 13Kb/s, by the time that is packetised and put in an IP packet it may well be 26Kb/s, but that easily fits into a broadband connection).

O2 happened to have bought a broadband provider (Bethere), so it's not just a marriage of convenience, it actually gives it a very strong proposition in the marketplace.he big question is how cheaply it can make a suitable BTS solution for comsumption in the open market. O2 is saying it can produce a combined cell/ADSL router for under $100 (around £60) which is around what a normal Wi-Fi ADSL router costs.

If it can pull it off, it has the broadband service and can offer local GSM connectivity using normal handsets without the problems that other services like BT Fusion suffer (specialised handsets with poor features, battery life etc). It, of course, could also offer data services like GPRS (general packet radio service) or even EDGE (Enhanced Data Rates for GSM Evolution - which came first the acronym or discription?) and use them for localised data hotspots much like there are for Wi-Fi, but using nothing more than a GSM phone connected to a laptop. Though O2 has a headstart, it will be interesting to see what innovative services the other guard band operators will bring to the game and who will survive in the long term.

Earlier this year, the frequencies 1781.7-1785MHz paired with 1876.7-1880MHz were made available under the Wireless Telegraphy Act (WTA). Two sets of 3.3MHz is a valuable commodity in terms of spectrum, so Ofcom "raffled" them off to the highest bidders with a reserve price of £50,000 per license. Up to 12 licenses would be awarded. Ofcom allowed anyone to bid on any number of license slots (i.e. from one to 12 licenses) and the award was made purely on a financial basis. Ofcom arranged the auction in a sealed bid process in a "what you bid is what you pay" arrangement, which led to the lowest price paid at £50,110 by Spring Mobil and the highest £1,513,218 by COLT.

Some have argued that the highest bidders paid over the odds, but Ofcom is putting a good spin on it saying it's in line with its mobile strategy. The total amount of the licence fees paid was £3.8m - not bad for Ofcom's first spectrum auction. Of course, compared to the license fees paid for 3G spectrum (around £6bn per license) it's peanuts.

In the end it was close, but 12 licenses were awarded. They are national UK licenses, though the operators of the licenses have to cooperate so they don't interfere with each other. As part of the license condition all licence holders had a obligation to Ofcom to agree on an engineering co-ordination plan for the joint use of spectrum. The industry group is called Mobile200 and 11 licensees joined - O2 was awarded observer status for the discussions as it refused on principle to pay to negotiate the code of practice. Though the licenses are only low power (sub 200mW compared to tens of Watts for traditional GSM systems), they are suitable for services such as in-building GSM, local area GSM (such as in a theme-park) or other constrained areas. There are 15 GSM channels available, each one being able to carry eight voice calls.

Having a reasonable number of channels will allow multiple operators to co-exist in an area and also allow single operators to cover larger areas (in such a way that multiple GSM basestations won't interfere with each other). If the cell is mounted on an external mast, it can't be more than 10 metres high, however, in-building use can be to any height (so build a plastic greenhouse on a terrace on Canary Wharf and you can get an "internal" cell quite high).

The 12 companies winning licenses and the prices they paid were:

British Telecommunications PLC - £275,112

Cable & Wireless UK (England) - £51,002

COLT Mobile Telecommunications Ltd - £1,513,218

Cyberpress Ltd - £151,999

FMS Solutions Ltd - £113,000

Mapesbury Communications Ltd - £76,660

O2 (UK) Ltd - £209,888

Opal Telecom Ltd - £155,555

PLDT (UK) Ltd - £88,889

Shyam Telecom UK Ltd - £101,011

Spring Mobil AB - £50,110

Teleware PLC - £1,001,880

Having a license is all very well, but now licencees must be wondering what they've got themselves into. Just because they can run a GSM service doesn't mean anyone will use it, in fact it may well be difficult to get people onto your network. It's extremely unlikely the existing mobile operators are going to want to have anything to do with these new upstarts, they've invested millions (err, billions) to get to where they are today. The last thing they want is new entrants poaching customers or moving users off their networks when they move into, say, an office environment. They especially don't want their customer doing it with equipment (i.e. handsets) that they've heavily subsidised.

Unfortunately, what this means is that the new players are going to have to issue new SIMs (subscriber identity modules) and they won't work on existing GSM networks, or users will manually have to select the new network when they're in range. This makes it all very difficult, and users won't bother if it's hard. New entrants could enter into roaming agreements with the current operators, but unless Ofcom mandates this (which is unlikely) there's likely to be strong opposition. Since some of the license winners already have GSM networks, they can offer localised services knowing there's no interference problems with existing infrastructure.

One way ahead is for a licensee to make an agreement with a foreign operator and the localised network just becomes an extension of their network, but then when users roam on to the network they'll be subect to roaming charges which, as both Ofcom and the EU Government know too well, can mean very high charges for the end-user. If roaming charges do decline, this may well be a way forward.

There's also a big potential opportunity for the Channel Islands GSM networks here, as they abide by UK numbering plans, so though they are considered "foreign" their numbers look like UK numbers, including mobile ranges. They could offer roaming agreements and even offer SIMs which would still look like UK numbers, unfortunately as they are foreign operators, high roaming charges still apply. Just because the licensees have got a license, that doesn't give them the facilities to run a GSM network, it just allows them too. There's much more that's actually required to put a GSM network in place, all MMSC/SMSC, HLR etc.

If a big mobile operator was to offer a pico cell solution, they generally have a major problem as they don't want the pico cell to interfere with their existing network. Operators use what's known as a seven cell repeat patern. Each cell has six sectors (the six aerials that can be seen on a cell site). Cells and sectors can't use adjacent frequencies or they'll interfere. The seven cell repeat pattern ensures that frequencies can be re-used without interfering, but in the next seven cell pattern. O2 now has a very efficient way of dropping new cells into places, using new frequencies which are guaranteed not to interfere with O2's existing network - or any other major operator's. It does have to mind other GSM "pico operators", but as the power output is small, even this can be easily mitigated. It has a choice of 15 frequencies, so even if another "pico-operator" is nearby, they can both choose different (non-adjacent) ones.

Where O2 really gains is in the in-building/home use. One of the major costs of providing a GSM network is getting the calls back from the cell. By utilising a pico cell and a broadband connection, O2 has reduced this to practically zero, so it can offer cheaper calls just on that reduction. O2 does need to convert the calls to VoIP (voice over IP) and that increases the bandwidth required (GSM encoding uses 13Kb/s, by the time that is packetised and put in an IP packet it may well be 26Kb/s, but that easily fits into a broadband connection).

O2 happened to have bought a broadband provider (Bethere), so it's not just a marriage of convenience, it actually gives it a very strong proposition in the marketplace.he big question is how cheaply it can make a suitable BTS solution for comsumption in the open market. O2 is saying it can produce a combined cell/ADSL router for under $100 (around £60) which is around what a normal Wi-Fi ADSL router costs.

If it can pull it off, it has the broadband service and can offer local GSM connectivity using normal handsets without the problems that other services like BT Fusion suffer (specialised handsets with poor features, battery life etc). It, of course, could also offer data services like GPRS (general packet radio service) or even EDGE (Enhanced Data Rates for GSM Evolution - which came first the acronym or discription?) and use them for localised data hotspots much like there are for Wi-Fi, but using nothing more than a GSM phone connected to a laptop. Though O2 has a headstart, it will be interesting to see what innovative services the other guard band operators will bring to the game and who will survive in the long term.

Monday, October 9, 2006

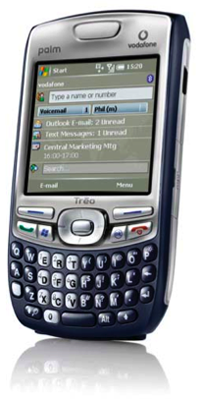

Treo 750 Review

Palm's Treo 650 was undoubtedly the company's best smart phone release in the UK, and while the 750v offers only a couple important new features - Windows Mobile 5.0 and 3G connectivity - it's nonetheless a big step forward. But it's not the leap ahead that its predecessor was over the 600, and there are still some surprising omissions.

Palm's Treo 650 was undoubtedly the company's best smart phone release in the UK, and while the 750v offers only a couple important new features - Windows Mobile 5.0 and 3G connectivity - it's nonetheless a big step forward. But it's not the leap ahead that its predecessor was over the 600, and there are still some surprising omissions.The 750v is clearly a member of the Treo family - Palm has tweaked the design, but there's nothing radically new here. Yes, the antenna stub's gone, which is a bonus. While not for me a deal-breaker, the antenna certainly was for many other potential European buyers. The corners of the phone are less pronounced, but the new model has a more angular look reminiscent of Vodafone's BlackBerries, particularly the 7100v.

Palm has shaved a millimetre or so off the 650's dimensions - more if you include the 650's antenna - and 24g off its 178g weight, but the 750v counter-intuitively felt to me to be larger than the 650. The features on the back of the device are all there - speaker, camera, external aerial connector, battery compartment - just rearranged slightly. The 750v's dark blue and silver colour scheme is suitably sober and corporate-friendly. The blue area is tactile - it's vaguely rubbery - and feels good.

The front's much the same as before too, with essentially the same array, this time tweaked for Windows Mobile rather than the Palm OS. The QWERTY microkeyboard is more 'smiley' than before, but I'm not convinced it's an improvement or a hindrance. The bigger call make and break buttons - positioned now next to Windows Mobile Today and OK keys - gets a thumbs up, though, as does the enlargement of the two keys above them, and their reallocation as soft-menu keys rather than application launch buttons.

The big change is the display, reduced from the 650's 320 x 320 to a more Windows Media-friendly 240 x 240. It's still a 16-bit colour job, but the smaller resolution doesn't make itself felt, and the UI looks as good here as it does on other, larger-screened Windows Mobile devices. The screen's nice and bright, and you can turn the backlight down a fair way, to conserve battery power, without it getting too dark. Outdoors, in bright light, it's not so easy to read, but then the screens on few smart phone are in these conditions.

The top of the device is still home to the very handy mute switch, but the SIM slot's now inside, under the battery. The 650's top-mounted infrared port can be found on the 750v's right side above the covered Mini SD slot - the cover also protects the 750v's reset switch. The left side of the phone is, once again, home to the volume control and a third button that, this time round, activates Windows Media Player when held.

Palm's Multi-Connector can be found on the base next to the 2.5mm headset socket and microphone. Multi-Connector is well established now, so accessories shouldn't be a problem.Internally, the spec's little changed: a 300MHz Samsung CPU replaces the 650's 312MHz Intel XScale part, and the memory's now up to 128MB - all of it Flash, as before. Once apps have be run once, they start up again quickly. The 750v never felt sluggish.

The camera's now up to 1.3 megapixel, but the 2x zoom is unchanged. There's no front-mounted camera for video calls, which suggests Palm and Vodafone doesn't think Treo users want 3G for that sort of thing, so they probably won't be overly bothered by the below-par camera resolution. There's no HSDPA here, but the 3G tri-band UMTS connectivity is backed by quad-band GSM/GPRS/EDGE support, making the 750v ideal for roaming. In the UK, call quality was fine. The call strength icon rarely dropped below two bars - much like the 650, despite the lack of antenna stub. The 650 also introduced Bluetooth to the Treo family, and while the 750v is still a Bluetooth 1.2 device, it now has A2DP stereo audio support.

Other tweaks include voice commands, voice recording and streaming media support, all three features inherited from Microsoft. All welcome, of course, but none I'd drop a 650 for. Which leaves, as I said, connectivity and the OS the key considerations here.

The 750v is a good Windows Mobile device. As I said, the screen looks good and provides ample space for information readouts provided you don't turn the on-screen keyboard or character-entry area on. And why would you? The 750v's keyboard is entirely fit for purpose, and with a clearly marked numeric pad, much better to use, I'd say, than any on-screen dial keys. With one hand or two, it's good to use. There is a phone dial pad, though, if you want one.

Yes, 240 pixels isn't as good as 320, but I found it less of an encumbrance than I'd expected it to. Even 240 x 320 displays are limited, particularly with apps like Internet Explorer, and the missing 80 pixels add up to surprisingly little extra screen space. Speaking of browsers, the 750v does indeed use IE rather than Palm's own browser, Web, which remains the better of the two at rendering for the small screen websites designed for large monitors.

That said, when I added more than two speed-dial numbers, the web search field was pushed off the Today screen, reachable only by adjusting the scroll bar. This could happen with a 240 x 320 display, of course, but it's a little less likely, and Palm missed a trick by implementing the speed dial listing as a pop-up menu which, oddly, the speed-dial entries actually look like. As it stands, the scroll bar severely weakens the Today screen's role as at-a-glance status display.

I'm pleased to say, though, that Palm's instant messaging metaphor for presenting text messages has been carried over from the 650. Palm has also improved the standard Today screen with its own layout, adding a space for contact look-up and phone number entry - so there's no Phone screen here - as well as a drop-down menu of speed-dial numbers and a web search entry field. And Palm appears to have done a better job than other Windows Mobile device makers of adapting the OS to stylus-free usage.

There is a stylus on board, just in case - a thin but full length job that's better, I'd say, than most and certainly an improvement on the telescopic stylii used by many other Windows Mobile handsets. You will need the stylus now and then, typically in apps where the focus is fixed on a text-entry field, but there's probably not much Palm - or HTC for that matter - can do about that until Microsoft writes Windows Mobile for single-handed, keyboard input first, stylus input second, and not the other way round.

Actually, a stylus does prove handy in one respect: for reseting the system. The 750v's reset button is hidden under the Micro SD card slot cover. I had need of it two or three times during the time I spent with the smart phone. I didn't have to do so with the 650, so I'd say it's a Windows Mobile issue rather than a Palm one.

The 750v provides Windows Mobile's own Outlook client for access to POP, IMAP and Microsoft Exchange Server, the latter with push email support. Vodafone's own push email service is delivered through a separate client app licensed from Visto. The Today screen's Email soft menu, incidentally, links through to Outlook rather than the Visto software, but it's clear the carrier wants you to use the latter: despite setting up my standard - and frequently used - POP and IMAP email accounts in Outlook, the 750v refused to connect to either, even with a 3G connection already established.

For all the WLAN-enabled handsets out there from HTC and its partners, from Nokia, from Sony Ericsson and from others, Wi-Fi still isn't part of the Treo specification. So there's no using your home or office hotspot to access the internet and email cheaply.

With its Windows Mobile foundation, the 750v should be a candidate for VoIP, over the 3G link since there's no Wi-Fi. Out of the box, the phone won't connect to Skype's website, which the phone reports has been restricted by the carrier. Vodafone, it seems, believes 750v buyers are, by default, under the age of 18 and therefore blocks access to www.skype.com. IE presents a link to turn off this restriction, but all I got was a web server error message when I tried it on the 750v.

It gets worse. You're not even allowed to send pictures taken on the phone's camera by Bluetooth, only email or MMS - usage of which, unlike Bluetooth, renders gold unto Vodafone. You can't send files to the Treo by Bluetooth either. For the 750v, it seems Bluetooth exists only to connect the handset to wireless earpieces. Admittedly it's a while since I used one, but I don't recall the unlocked Treo 650 imposing these kinds of limitations.

None of this reflects well on Vodafone. Palm's own support site cast the handset maker in a better light - it appears non-Vodafone 750s will be allowed to do some if not all of this stuff. It's a shame because in all other respects the 750v is an excellent smart phone. Consequently, a device that might have scored 80 or 90 per cent rates much lower.

The 750v is at least a 3G device, and while there's no HSDPA high-speed download support, I got some good data transfer numbers from vanilla UMTS connections. A 23.1MB file downloaded from Microsoft's website took a little over six minutes to download - roughly 513Kbps.

Palm's Treo 750v is an impressive addition to its smart-phone line-up. It's an eminently workable Windows Mobile device, and while I personally prefer the Palm OS, the Microsoft OS has evolved to become a worthy alternative. In some ways it's better, particularly given its push email support and Exchange Server compatibility. And Windows Mobile in no way hinders the classic Treo experience.

3G is clearly a boon too. It's pity there's no HSDPA support, but Vodafone's funny about giving smart-phone users access to it, in any case. In fact, if there's a flaw with the 750v it's the carrier. The restrictions placed on users go too far for me, genuinely preventing me from performing tasks on the 750v that I can easily do on other network-tied handsets. Unless you're wedded to Vodafone, I'd wait for until its exclusivity period ends and Palm releases an unlocked 750!!

Monday, September 25, 2006

Orange Concentrates on UMA

The first competition in the convergence space is likely to kickoff in November, with both BT, and France Telecom's mobile unit Orange, introducing similar products at the same time. Mobile operator Orange gave details on its forthcoming fixed mobile convergence service Monday, which will allow its customers to use a mobile handset to make calls over broadband. While not first in the UK, Unique is the first service of its type to arrive since BT's Fusion offering. Initially, Orange will have three handsets to choose from - the Motorola A910, Nokia 6136 and the Samsung P200. When at home, the mobile handset connects via wi-fi to the Orange Livebox hub and calls are routed via the internet. Outside of the 'home zone' the handset routes calls via Orange's mobile network. BT's Fusion service works on a similar premise - the technology is known as Unlicensed Mobile Access (UMA) - but to date, Fusion has only been able to offer "home zone" calls over Bluetooth, as wi-fi-enabled handsets are not yet available.

The first competition in the convergence space is likely to kickoff in November, with both BT, and France Telecom's mobile unit Orange, introducing similar products at the same time. Mobile operator Orange gave details on its forthcoming fixed mobile convergence service Monday, which will allow its customers to use a mobile handset to make calls over broadband. While not first in the UK, Unique is the first service of its type to arrive since BT's Fusion offering. Initially, Orange will have three handsets to choose from - the Motorola A910, Nokia 6136 and the Samsung P200. When at home, the mobile handset connects via wi-fi to the Orange Livebox hub and calls are routed via the internet. Outside of the 'home zone' the handset routes calls via Orange's mobile network. BT's Fusion service works on a similar premise - the technology is known as Unlicensed Mobile Access (UMA) - but to date, Fusion has only been able to offer "home zone" calls over Bluetooth, as wi-fi-enabled handsets are not yet available.BT has previously said it will roll out the Motorola A910 as soon as it becomes available, which means competition in the UMA space is likely to kick off proper in November, when both operators launch similar services. Orange also plans to launch the service to its customers in France, the Netherlands, Spain and Poland at the same time as the UK.

BT meanwhile, is expected to introduce the corporate version of its Fusion service in Italy in early 2007, followed by a phased international roll out in Germany, Benelux, Spain and France.

Carrie Pawsey, telecoms analyst at Ovum, said ealier this year that BT's Fusion will face issues such as billing integration with Vodafone, BT's cellular partner. Through its integration with France Telecom, Orange's Unique customers will receive a single bill from Orange for converged calls and broadband access.

But on a side note, analysts believe that UMA offerings have been hamstrung by a lack of available handsets, as BT's long wait for a wi-fi-enabled device testifies. In the interim, other operators such as Telefonica Moviles, which have gone down the Session Initiation Protocol (SIP) route to drive their wireless VoIP strategy look set to steam ahead in the future. Although UMA is 3GPP standards-based, SIP and IP Multimedia Subsystem (IMS) implementations are thought to have a longer term and much clearer evolutionary roadmap. However, IMS and SIP have a far higher entry cost and as such may be unpopular for "concept testing". UMA over Bluetooth / WiFi is far easier to esrtablish and then develop into a SIP based proposition as that technology along with IMS is rolled out in Core networks.

Wednesday, August 30, 2006

Mobile TV. At What Price, and When?

Mobile broadcast TV is the next big thing, apparently. It is the killer app, the cash cow, the panacea to all mobile ills. Given it time it will eradicate third-world debt, solve the Middle East crisis, colonise Mars and even - though this may be asking a bit too much - expunge the dandelions from my front lawn. You may detect a certain amount of hyberbole in the above but only a little more than has already been put about by Mobile TV adherents. Worried by declining voice ARPU and increasingly twitchy about messaging adoption reaching saturation point, operators are hoping that rich-media services will realise sufficient revenues to ensure that overall ARPU levels pick up once more. And chief amongst these services is television.

Mobile TV is brilliant. Everyone wants it. You want it. The operators have taken to repeating this, like a mantra, possibly in the belief that if they restate it enough times, then the public will start to believe it. Indeed, recent research conducted by O2 and Arqiva would seem to lend some credence to these claims. Following a five-month trial of a mobile TV service using DVB-H technology, 72 per cent of participants said that they would buy the service (if available at any acceptable price) within 12 months; 57 per cent within six. If the adoption rate within the O2 sample demographic (18-44 years) were replicated across the entire UK population, then within six months mobile TV would have around 11 million subscribers, rising to 14 million after a year. At which point the O2 mobile TV team would retire to Barbados. Of course, neither O2 nor Arqiva would be so rash as to make such extrapolations from these trials, which is why they haven't yet bought those West Indian villas: however, in order to recoup investment costs, let alone generate the kind of revenues that will make broadcast TV the saviour of the mobile industry, any service must, fairly rapidly, acquire a subscriber base of several million.

Let us assume that a UK operator finally gains access to UHF spectrum and deploys a DVB-H network. For that the operator is likely to pay at least EUR300m. Let us also assume that the operator has partnered with a broadcast or broadcasters and has managed to put together a compelling package. The operator is then faced with the prospect of selling this bouquet to the consumer. This may well be a problem, as the consumer will probably not have a handset that can receive mobile TV. The crux of the matter is that, for the medium term at least, handsets capable of receiving DVB-H or whichever becomes the de facto, will be specialised, high-end devices. I see no point in buying a specialised handset unless the service for which that handset is specialised has been made available.

Accordingly, the audience at the outset will be zero or fairly close to it. While numbers will climb after the service becomes established, the operators will typically be relying on contract customers, due for a handset upgrade, to pay a premium to move up to the DVB-H-enabled model; for prepaid customers, the initial outlay will be significantly higher still. Suddenly, the research qualification, "at an acceptable price", becomes terribly important. A significant number of customers might be prepared to pay up to £10 pounds a month for a mobile TV bouquet on an existing handset; but how many of those would pay the substantial premium for a high-end handset? Furthermore, before they cough up for this all-ARPU enhancing service, would-be customers would like to be reassured that they will actually receive it.

In the UK, 2G coverage is, according to the networks, at or around 99 per cent of the population. I am increasingly of the opinion that this 99 per cent refers to specific individuals rather than the area in which they live, with myself as part of that ill-fated 1per cent : in various locations where I have found myself over the past few years (Cambridgeshire, Chichester; Network South Central) I have found myself unable to receive a voice call or text message, let alone streamed video. And 3G coverage is considerably less than this, at around 70 per cent . If one is standing still. And outdoors... Generally speaking, subscribers to the UK's BSkyB service receive uninterrupted programme coverage. Let's envisage a scenario whereby the picture became blocky every few minutes, or simply vanished at regular intervals - particularly galling if you were watching a sporting event. You would rapidly tire of this and, after a few well-aimed words at someone in a Livingston call centre, you would cancel your subscription. I would venture to suggest the same might be true of those subscribing to mobile TV.

One of the largest potential audiences for mobile TV are the long-distance commuters, particularly train passengers with nothing better to do for an hour or two. This is a problem for mobile TV solutions providers because, as yet, none of the technologies is demonstrably robust at high speeds. Finally, we must return to the question of how many people are actually prepared to pay for a TV service, and - most pertinently - for content for which many of them already pay? In the UK, around ten million households already subscribe to a pay TV service. Adoption has slowed markedly in recent years, suggesting that further growth potential is limited. People are simply not interested in paying for additional TV channels.

A significant proportion of any wannabee mobile TV operator's user base would therefore be drawn from residents of households which already subscribe to a pay TV service. It also seems likely that the overwhelming majority of channels will replicate the existing content, including premium channels such as Sky Sports and Sky Movies. Our BSkyB subscriber is therefore being asked to pay out an extra £10 to £15 a month on top of the £30 to £40 pounds he's already committed to. This is not going to happen. The model may succeed if existing Sky customers are offered mobile content at a significant discount to the standard price, but this then requires the operator signing up twice as many customers as before just to break even.

So, given these obstacles, what are the prospects? For the much-vaunted DVB-H standard: not good in the short term. For one of the larger Western European countries, such as the UK or France, cumulative national mobile broadcast revenues are unlikely to surpass rollout costs for a single DVB-H network and licensed spectrum until four years of service have elapsed; factor in additional expenses for items such as broadcasting rights and running costs, and the prospects seem slimmer still. Of course, DVB-H is not the only standard. Indeed, the vendors, too, have convinced themselves that there is a ubiquitous desire for pay mobile TV services.

As a result, operators have been faced with a plethora of broadcasting solutions - DVB-H, DAB-IP, T-DMB, ISDB-T, MediaFLO, TDtv, S-Band - with which they will make their billions. But the other standards have their drawbacks: while DAB-IP is cost-effective, it has to share spectrum with existing radio content and as a result can offer only a limited number of TV channels. Similarly, for T-DMB to be cost effective, its launch would have to be synchronised with that of digital radio content across the same network. Other drawbacks are less technological than political: in a standards contest which has echoes of VHS/Betamax video struggle in the early 1980s, vendors, operators and industry groups are championing their own pet solutions. While Nokia, Samsung and LG have lined up handsets for DVB-H, MediaFLO and DMB, European vendors have so far been lukewarm to technologies other than DVB-H. Even Alcatel's S-Band variant of DVB-H, a hybrid satellite/terrestrial repeater solution which has the potential of providing international coverage, reduced network deployment costs (essentially comprising an upgrade to existing 3G networks) and readily available spectrum, has yet to win their full backing.

The worst-case scenario in all this is that operators may fail to reach a joint decision on network standards, or even network sharing, with the result that two competing networks are rolled out, to the financial ruin of all parties involved. In such circumstances, mobile TV will only be the killer app inasmuch as it will be the app that killed its operators.

It could well be that mobile TV turns into a free for all, but what about the alternatives? Streaming over UMTS fr example requires very little technology, its not rocket science and it drives exposure and gains market traction. I think Doctor Holden has missed the fact that the technology to deliver video content is here, and future advances will only add to the user experience.

Subscribe to:

Comments (Atom)